Today I heard from a 74-year-old woman in our community — a retired factory worker on a fixed income, living in a visibly deteriorating home. It’s a warm, inviting place, but time and weather have clearly taken a toll on its value.

Her house is paid off.

But this year, the county raised her total assessed value from $71,725 to $104,785.

That’s a 46% increase in one cycle.

Her land went up by 47%. Her outbuildings — mostly sheds — more than tripled. Her dwelling alone jumped nearly 39%, despite obvious signs of wear and no repairs or improvements.

That means her total housing cost — factoring in property tax, insurance, and escrow — will rise by more than 50%. In one cycle. For someone like her, this isn’t just hard. It’s destabilizing.

And just a few miles away, a County Board member’s substantial, improved brick home — assessed at over $1 million — saw a 0% increase in dwelling value.

Same as last year. No change.

Like many of you, she’s been quietly following along with the three-part series of facebook posts around the topic of property tax valuations letters, trying to understand what’s happening. She wasn’t one of my sample homes. I didn’t find this — she did.

Here’s what she discovered.

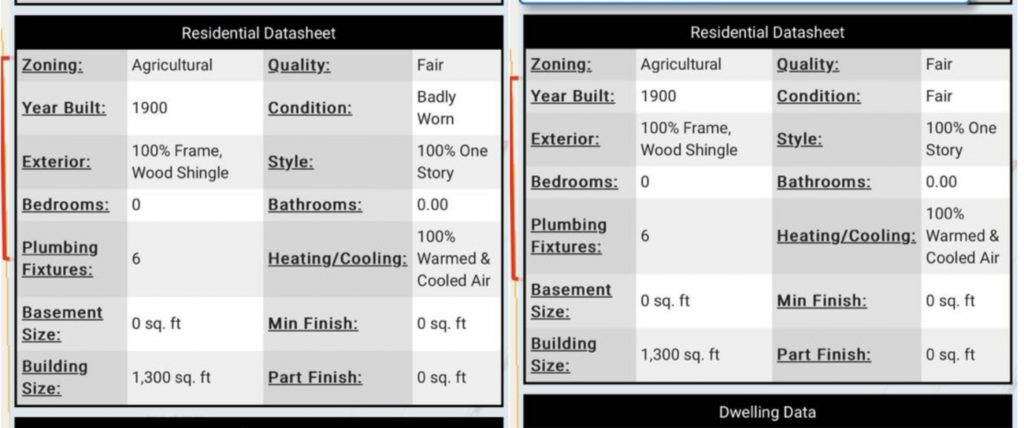

She visited the county’s valuation website the day she got her notice. Unsure what she was looking at, she took screenshots. Six days later, after reading more and learning how to interpret the numbers, she went back to double-check. And something had changed.

The “condition” of her home had been silently upgraded — from “Badly Worn” to “Fair.”

No repairs. No inspection. No notice.

That doesn’t make sense. Homes that are deteriorating don’t improve midweek.

In CAMA systems (the software used to calculate valuations), “condition” is a major driver of assessed value. Change it, and the algorithm justifies a higher price. Leave it uncorrected, and it becomes the new baseline — locking in inflated taxes for years to come.

This is changing the score after the game.

Under Nebraska law, counties must fix property values as of January 1. After that, the 30-day protest period — held in June and happening right now — gives property owners a legal window to challenge those values. During that time, core valuation data must remain frozen.

That’s not a courtesy. It’s a rule — designed to ensure the current assessment cycle completes with integrity before the next one begins in July.

Changing key data during the protest window didn’t just tilt the field. It may rob her of her right to make a fair case.

If you’re concerned, now is the time to act.

Go to the County Assessor’s Office and formally request two things:

- A copy of your property record as it appeared before June 1, and

- A copy of your current record.

You have a legal right to this information. And if anything has changed — condition, quality, structure, or components — you have a right to challenge it.

Don’t assume that what’s online today is what was used to set your value.

These records aren’t just paperwork — they’re the foundation of what we’re being asked to pay.

And when that foundation shifts during our only window to speak up, something is broken.

There are simply too many irregularities and technical inconsistencies — raising serious, fair questions about whether our taxes reflect the truth, or something else entirely.

As such, outreach to Senator Dorn has begun.

– Max